I hope you find the currency overview below of interest to you, if you are thinking of purchasing a home in Italy and are worried about currency exposure, we can direct you to the best people to give you up-to-date advice with a variety of services which can benefit you and also save you money.

Euro

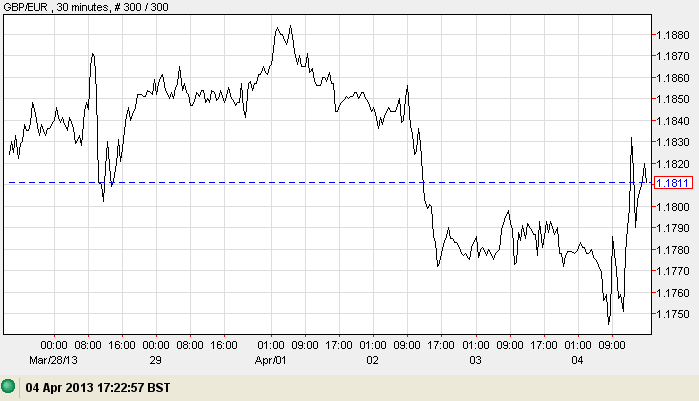

For all the obvious reasons the euro found itself at the bottom of the heap last week. It lost a cent and a half to the pound and a cent and three quarters to the US dollar.

Investors were taken aback by the scale and scope of the capital and exchange controls imposed on Cyprus, not to mention the expropriation of bank deposits. Some depositors will have lost 80% of their money. To make matters worse, the EU has declared that the rescue of Cyprus will serve as the template for any future bailout.

Not surprisingly, investors are looking nervously at their bank deposits in other creaky corners of the eurozone periphery. Were they to pull their money out the European Central Bank could fill the gap easily enough but only at the risk of more losses, ultimately, for German taxpayers.

US Dollar

The dollar was unchanged on the week against the pound. It gained one and three quarter cents against the euro.

Sterling and the dollar were both seen as worthy alternatives to the euro by investors who were uneasy about the way the EU/IMF/ECB troika had botched the bailout of Cyprus, confiscating bank deposits and imposing capital and exchange controls on euros held in Cypriot banks.

Whilst the US economic data fell short of sparkling, on average they were not too bad. New and pending home sales were lower on the month and higher on the year. The Conference Board's index of consumer confidence deteriorated by eight points to 59.7 while the University of Michigan measure was a point higher at 78.6. Final figures for the fourth quarter of 2012 showed the US economy expanding by an almost invisible 0.1%. For the year as a whole growth was a more respectable 2.2%.

Canadian Dollar

The Loonie strengthened by just over a cent against sterling. Coincidentally it kept pace with the New Zealand dollar.

The two currencies were seen as suitably distant from Euroland both in an economic and geographic sense. This was relevant because investors were uneasy about the way the EU/IMF/ECB troika had botched the bailout of Cyprus, confiscating bank deposits and imposing capital and exchange controls on euros held in Cypriot banks.

There were only a couple of sets of Canadian economic data. Raw material and industrial product prices showed manufacturers' costs continuing to rise more quickly than factory gate prices but with a narrowing gap. The Bank of Canada's consumer price index numbers revealed a sharp jump in inflation from 0.5% to 1.2%. The news was positive for the Canadian dollar because of its implications for higher interest rates sooner.

Australian Dollar

The Aussie was unchanged on the week against the pound and the US dollar.

All three were seen as worthy alternatives to the euro by investors who were uneasy about the way the EU/IMF/ECB troika had botched the bailout of Cyprus, confiscating bank deposits and imposing capital and exchange controls on euros held in Cypriot banks.

The week's Australian economic data gave investors nothing to play with. Melbourne University's estimate of inflation put it slightly lower at 2.1% and lending to the private sector increased by a monthly 0.2% and an annual 3.4%, almost exactly as forecast. When the Reserve Bank of Australia kept is Cash Rate unchanged at 3% the accompanying statement implied less likelihood of a cut in the foreseeable future.

New Zealand Dollar

The Kiwi strengthened by just over a cent against sterling. Coincidentally it kept pace with the Canadian dollar.

The two currencies were seen as suitably distant from Euroland both in an economic and geographic sense. This was relevant because investors were uneasy about the way the EU/IMF/ECB troika had botched the bailout of Cyprus, confiscating bank deposits and imposing capital and exchange controls on euros held in Cypriot banks.

Economic evidence from New Zealand was in typically short supply and told a mixed story. The issue of building permits increased by a useful 1.9% in February while business confidence faded. The Kiwi received a useful boost from news that the balance of trade swung from a $287m deficit to a $414m surplus in February, even though it still left a billion-dollar shortfall for the 12 months.